Get in touch

10/23/3035

How to Prepare Your Home Electrical System for an EV Charger

Electric vehicles (EVs) are no longer the future — they’re the present. Whether you drive a Tesla, Rivian, or Chevy Bolt, charging your car at home is the most convenient and cost-effective way to stay powered.

But before you schedule an installation, it’s important to make sure your home’s electrical system can safely handle the extra load. Installing a Level 2 charger (the most common residential choice) requires more than just an outlet — it often needs a dedicated circuit, permit approval, and sometimes a main panel upgrade.

Here’s what every Bay Area homeowner should know before adding an EV charger.

Step 1: Check Your Electrical Panel Capacity

Your electrical panel — also called your main service panel — is the control center for your home’s power. It distributes electricity to all your appliances, outlets, and lighting circuits.

Most modern EV chargers draw between 30 and 50 amps of continuous power. If your home has a 100-amp panel, that’s often not enough to safely support an additional circuit for a Level 2 charger.

Look inside your panel:

If it’s labeled 100A, you may need a 200A main panel upgrade.

If you see an older brand like Federal Pacific or Zinsco, it’s likely time for replacement regardless of charger installation.

At Ally Electric & Solar, our licensed electricians perform a load calculation to determine if your home’s system can handle the added demand.

Step 2: Choose the Right Charger Type

There are two primary residential charger types:

Charger LevelVoltageTypical Charging SpeedCircuit RequiredLevel 1 120V (standard outlet)3–5 miles of range per hourNone (uses standard plug)Level 2 240V (dedicated circuit)25–40 miles of range per hour40A–60A breaker

For daily convenience and faster charging, most homeowners opt for Level 2 chargers — such as the Tesla Wall Connector, ChargePoint Home Flex, or Emporia EV Charger.

These require professional installation and a dedicated 240V circuit, which must comply with California Electrical Code and PG&E interconnection standards.

Step 3: Verify Permitting and Utility Requirements

Installing an EV charger isn’t just about plugging in — it’s an electrical upgrade that requires city permitting and sometimes coordination with PG&E.

Your installer will handle the permit application, inspection scheduling, and PG&E notification (if applicable).

At Ally, we include these services in every installation — ensuring your system passes inspection and qualifies for rebates such as:

PG&E EV Charge Rebate

California Clean Vehicle Rebate (CVRP)

These incentives can help offset installation costs for qualified homeowners.

Step 4: Plan for Future Energy Upgrades

If you’re considering solar panels or a home battery system in the future, it’s smart to plan your EV charger installation with expansion in mind.

A properly sized 200-amp main service panel not only supports your EV charger but also prepares your home for:

Solar PV system integration

Battery backup (e.g., Tesla Powerwall, Enphase IQ Battery, FranklinWH)

Heat pump or induction appliances

By upgrading once, you avoid costly rework later — making your home fully “electrification-ready.”

Step 5: Schedule a Professional Inspection

Before installation, a licensed electrician should evaluate:

Your panel’s amperage rating and available breaker space

Wiring condition and grounding

Distance between the panel and the parking area

Site feasibility for conduit and charger placement

Ally Electric & Solar provides a home inspection to assess all of the above. Once your system is approved, we handle the installation, permitting, and setup — so you can start charging confidently.

Power Your Drive with Ally Electric & Solar

Installing an EV charger is one of the best upgrades you can make for convenience, sustainability, and long-term savings.

At Ally Electric & Solar, we specialize in EV charger installations, main panel upgrades, and solar + battery systems across the Bay Area. Our team handles every step — design, permitting, installation, and PG&E coordination — ensuring your home is safe, efficient, and ready for the road ahead.

Schedule Your Free EV Charger Consultation

Ally Electric & Solar, Inc.

California Licensed Electrical Contractor — License #806465

Serving the Greater San Francisco Bay Area

info@allyelectricandsolar.com

(510) 559-7990

www.allyelectricandsolar.com

Book your free EV charger inspection today and we’ll help you choose the right charger, verify your electrical capacity, and provide a no-obligation quote.

10/02/2025

PG&E NEM 3.0 and Solar Batteries: How California Homeowners Can Maximize Savings in 2025

If you live in Northern California, you’ve probably heard of PG&E’s NEM 3.0 program and the changes it brought to solar customers in 2023. Many homeowners are now asking the same question: Is solar still worth it in 2025?

The short answer is yes — but the way you design your system matters more than ever. Under NEM 3.0, solar plus a battery is the winning combination for lowering bills, improving energy independence, and protecting your home during outages.

In this guide, we’ll break down what changed, how it affects your PG&E bill, and why batteries like the Tesla Powerwall 3, Enphase IQ 10C, and FranklinWH aPower are becoming essential for California homeowners.

What Changed Under PG&E’s NEM 3.0?

Under the previous program (NEM 2.0), homeowners earned near-retail credit for each kilowatt-hour they exported back to the grid. That meant solar panels alone could dramatically cut electricity bills — even without a battery.

With NEM 3.0, the value of exported electricity has been reduced by roughly 75% on average. Instead of being credited at close to the retail rate, exported power is compensated at the “avoided cost” rate, which is based on wholesale electricity prices.

Daytime exports (midday) are worth much less.

Evening energy (4 p.m. – 9 p.m.) is expensive, and that’s when solar panels aren’t producing.

This shift makes it harder to save money with solar panels alone, because you’re sending energy to the grid when it’s cheap and buying energy back when it’s expensive.

Why Batteries Are the Key to Savings

The new rules change the math — but they also highlight the value of solar battery storage. A battery allows you to:

Store excess solar power during the day.

Use it in the evening when PG&E’s rates are highest.

Reduce exports at low daytime rates.

Cut peak demand charges.

In other words, batteries help you keep more of the energy you generate, shifting your savings from export value to self-consumption value.

Even better: batteries provide backup power during blackouts — something many Bay Area homeowners worry about, especially after recent wildfire seasons and earthquakes.

Incentives in 2025: ITC + SGIP

The cost of adding a battery has dropped significantly thanks to federal and state incentives.

Federal Tax Credit (ITC):

The 30% credit applies to solar and batteries through at least 2032.

Stand-alone batteries also qualify (even if you already have solar).

California SGIP (Self-Generation Incentive Program):

Rebates are still available in 2025, especially for homes in fire-threat or outage-prone areas.

Typical savings: $2,000–$5,000 per battery.

Together, these incentives can cut the upfront price of a battery system by 30–40%, making it a financially smart move under NEM 3.0.

Real-World Example: Bay Area Home

Let’s look at a simple case study.

System size: 7 kW solar + 10 kWh battery

Without battery: Home exports most power at midday when rates are low. Monthly bill reduction: ~40%.

With battery: Stored energy offsets evening rates (often $0.40–$0.50/kWh). Monthly bill reduction: ~65–70%.

Over a 10-year span, the homeowner saves thousands more by adding a battery. And during PG&E outages, the battery provides reliable backup for lights, refrigeration, internet, and even essential medical devices.

Choosing the Right Battery: Tesla, Enphase, or FranklinWH?

At Ally Electric & Solar, we install several top battery brands. Each has strengths depending on your home’s needs.

Tesla Powerwall 3

High capacity (~13.5 kWh per unit).

Built for whole-home backup.

Sleek design, widely recognized.

Enphase IQ Battery 10C

Modular — you can add units over time.

Works seamlessly with Enphase microinverters.

Good option for homes starting with a smaller system.

FranklinWH aPower + aGate

Strong load management features.

Robust warranty and growing popularity in California.

Flexible for both new installs and retrofits.

Which is best? It depends on your household usage, backup needs, and budget. Our team helps homeowners compare options with clear side-by-side analysis.

Beyond Savings: Energy Independence and Resilience

While much of the NEM 3.0 discussion is about dollars and cents, the bigger picture is energy independence.

Batteries make you less dependent on PG&E’s shifting rate structures.

You gain peace of mind during outages — whether from wildfires, storms, or earthquakes.

Electrification trends (EVs, heat pumps, induction stoves) mean households will rely even more on electricity. Pairing solar with storage ensures you’re ready for that future.

Final Thoughts

PG&E’s NEM 3.0 has changed the landscape, but it hasn’t made solar a bad investment. It’s simply shifted the smart strategy from solar alone to solar plus battery storage.

With the 30% federal tax credit and SGIP rebates still in place, 2025 is an excellent year to invest. By adding storage, you can:

Maximize bill savings.

Gain resilience during outages.

Future-proof your home for the electrification era.

Call to Action

At Ally Electric & Solar, we specialize in designing solar + battery systems tailored to California homes. Whether you’re considering the Tesla Powerwall 3, Enphase IQ 10C, or FranklinWH aPower, our team can help you choose the right solution for your budget and lifestyle.

Contact us today for a free consultation and see how much you can save under PG&E’s new rules.

9/30/2025

Heat Pumps and Solar PV + Energy Storage: Are They a Good Match?

In recent years, homeowners across California and beyond have been exploring how to cut energy costs and reduce carbon emissions. Two technologies often come up in the same conversation: heat pumps and solar photovoltaic (PV) systems with energy storage (ESS). But how do these solutions relate, and is combining them really the right move for every household?

What Are Heat Pumps?

A heat pump is an electric appliance that can both heat and cool a home by transferring heat rather than generating it directly.

Heating mode: extracts heat from the outside air (even in cold weather) and moves it indoors.

Cooling mode: works like an air conditioner, removing heat from indoors and releasing it outdoors.

Because they move heat instead of producing it, heat pumps can achieve efficiencies of 200%–400%, compared to around 90% efficiency for electric resistance heaters or gas furnaces.

How Much Electricity Do Heat Pumps Use?

Electricity consumption depends on:

System size (measured in tons or BTUs).

Climate zone (mild Bay Area vs. colder mountain regions).

Home insulation and ducting.

On average:

A typical residential heat pump uses 2,000 to 4,000 kWh per year for heating and cooling.

That translates to 15%–30% of a household’s total annual electricity use in California.

In colder climates, usage can be higher, especially if backup resistance heating is needed.

For comparison, the average California household consumes about 6,500–7,000 kWh annually (without electric vehicles or large electrification loads). Adding a heat pump can increase that number by 25%–50%, depending on usage.

Why Pair Heat Pumps With Solar + ESS?

Offset Higher Electricity Demand

Without solar, switching from gas heating to a heat pump can cause a noticeable jump in your electric bill.

A properly sized solar PV system can offset most or all of the added consumption.

Take Advantage of Efficiency

Heat pumps are already efficient compared to gas furnaces or electric resistance heating.

Running them on solar power makes heating and cooling nearly emissions-free.

Resiliency With Storage

Energy storage systems (like Tesla Powerwall or Enphase IQ Battery) allow homes to keep heating or cooling during outages.

In California, where blackouts and Public Safety Power Shutoffs (PSPS) are a concern, this adds peace of mind.

Peak Shaving

Many utilities have time-of-use (TOU) rates, with higher costs in the late afternoon/evening.

Pairing a heat pump with storage lets homeowners shift usage and avoid peak pricing.

Is It Always a Good Solution?

It depends on your situation:

Good fit if:

You live in a region with mild winters (like most of California).

You’re planning to replace aging HVAC equipment or gas furnaces.

You want to reduce reliance on fossil fuels and improve indoor comfort.

You already have or plan to install solar PV with sufficient capacity.

Potential challenges:

In very cold climates, heat pumps may need backup resistance heating, which increases energy use.

Upfront costs for both a heat pump and a solar + storage system can be significant.

System sizing is critical — undersized solar arrays may not cover the added load.

The Bottom Line

Heat pumps and solar PV + ESS are complementary technologies. Heat pumps make homes more energy-efficient and all-electric, while solar plus storage ensures that extra demand is met sustainably and resiliently. For many California homeowners, combining the two is a smart long-term strategy — but the right solution depends on climate, home size, and budget.

Before making the switch, it’s best to consult with both a licensed HVAC contractor and a solar professional who can model your home’s projected energy use and recommend the right system size.

9/24/2025

Earthquakes Remind Us: Why Solar + Battery Systems Are Essential for Bay Area Homes

Just a few days ago, the Bay Area was shaken by a 4.3-magnitude earthquake near Berkeley/Pinole. While this was a moderate event, it served as an important reminder that we live in an earthquake-prone region where power outages can occur at any time. As an electrical engineer working with residential energy systems, I see firsthand how families are left vulnerable when the grid fails — and why solar panels combined with energy storage systems (ESS) are no longer a luxury, but a necessity.

How Earthquakes Affect the Grid

During an earthquake, even a moderate one:

Utility infrastructure is vulnerable. Power lines, substations, and transformers can be damaged, leaving neighborhoods in the dark.

Gas pipelines pose safety risks. This makes electric cooking and heating a safer and more reliable option during emergencies.

Restoration can take days. Depending on the severity, PG&E crews may need hours — even weeks — to restore service to all customers.

For homeowners, that means no lights, no internet, no heating, and no way to safely store food unless they have a backup system.

Why Energy Storage Systems (ESS) Matter

When paired with solar panels, battery storage systems like the Tesla Powerwall 3, Enphase IQ, or FranklinWH aPower give families independence from the grid.

From an engineering perspective, here’s what these systems can provide after an earthquake:

2+ Weeks of Critical Power: A well-sized battery can keep essential loads running — refrigeration, lighting, phone charging, internet routers, and medical equipment — for up to two weeks when managed carefully.

Safe Cooking & Heating: Electric induction cooktops, microwaves, or small space heaters can run off stored solar power, eliminating reliance on gas.

Automatic Isolation from the Grid: Modern ESS units include rapid shutoff and islanding capability, which means when the grid goes down, your home seamlessly switches to backup power.

Recharge Daily with Solar: Unlike a gas generator that needs constant refueling, a solar + battery system recharges every morning — ensuring sustainability for as long as the grid is down.

Real-World Resilience for Bay Area Families

Living in the Bay Area means preparing for the unexpected. With earthquakes, wildfires, and storms becoming more common, resilience isn’t optional — it’s essential.

Families who invest in solar + battery systems are not just saving on monthly utility bills; they are also investing in:

Peace of mind during natural disasters

Energy independence from PG&E’s outages and rate hikes

A cleaner, safer alternative to gas generators

Final Thoughts

The Berkeley/Pinole earthquake is a reminder that the grid is fragile, but your home doesn’t have to be. With solar panels and a properly designed energy storage system, you can keep life moving — cooking meals, heating your home, and staying connected — even when the lights go out across the city.

At Ally Electric and Solar, we specialize in designing and installing solar + battery systems that protect families during outages. If you’d like to learn how to make your home more resilient against earthquakes and other emergencies, contact us today for a free consultation.

9/18/25

How Does the NEM 3.0 Application Work?

When you apply for solar or add a battery in PG&E’s territory, your contractor (like Ally Electric and Solar Inc.) files an Interconnection Application. This is how it works:

Submit Interconnection Application

System details (panels, inverters, batteries) are entered into PG&E’s portal.

Required documents: site plan, single-line diagram, spec sheets.

PG&E Review

PG&E checks that your system complies with Rule 21 interconnection standards.

They confirm system size, safety ratings, and that your main panel can handle the system.

Permission to Operate (PTO)

Once approved and inspected, PG&E issues PTO.

This is the official green light for you to run your solar + storage system and start receiving NEM 3.0 credits.

What Does This Mean for Homeowners?

Under NEM 3.0:

Payback is longer without storage → Solar alone saves less because export credits are lower.

Solar + Battery is the new standard → A battery allows you to store daytime power and use it at night, making your system pay off faster.

Energy Security → Batteries provide backup power during PG&E outages.

How Ally Electric and Solar Inc. Can Help

At Ally Electric and Solar Inc. (Richmond, CA – CSLB #806465), we’ve guided hundreds of Bay Area families through the PG&E application process. We handle:

Preparing and submitting your NEM 3.0 interconnection application.

Designing systems that maximize self-consumption under new rules.

Installing trusted batteries like Tesla Powerwall, Enphase IQ, FranklinWH.

Panel upgrades and permitting for seamless integration.

Take Action Now

The sooner you apply, the sooner you can lock in savings and protect your home from rising PG&E rates.

Contact us today to get started with your NEM 3.0 solar + storage consultation.

510-559-7700

info@allyelectricandsolar.com

www.allyelectricandsolar.com

CSLB License #806465

FQAs

1. If I sell excess energy to PG&E, will PG&E charge me for it?

No — PG&E does not charge you for exporting your excess solar energy. Instead, under NEM 3.0, they give you export credits on your bill. The difference is that these credits are now much lower (around 5–8¢ per kWh) compared to the near-retail credits homeowners received under NEM 2.0. That’s why using your own solar energy or storing it in a battery provides greater savings than sending it back to the grid.

2. Will I still get the 30% Federal Solar Tax Credit under NEM 3.0?

Yes. The 30% Federal Investment Tax Credit (ITC) is completely separate from NEM policies. It applies to both solar and battery systems installed through the end of 2025.

3. Is it still worth going solar under NEM 3.0?

Yes — but the strategy has changed. Solar alone saves less than it used to because export credits are lower. Pairing solar with a battery system allows you to store your extra energy and use it during expensive peak hours, which dramatically improves your savings.

4. Can I keep my old NEM 2.0 plan if I already have solar?

Yes. If your system was approved under NEM 2.0, you are grandfathered into that program for 20 years from your Permission to Operate (PTO) date. However, adding new solar capacity may trigger a new NEM 3.0 review. Adding only a battery (without increasing solar size) usually does not change your NEM 2.0 status.

5. How long does the NEM 3.0 application take?

After submitting your application and documents, PG&E typically takes 2–4 weeks to review. Once the city inspection is complete and passes, PG&E issues your Permission to Operate (PTO).

6. Can I charge my battery from the grid under NEM 3.0?

Yes, depending on the configuration. Systems like Tesla Powerwall and Enphase IQ Battery can be set to allow or prevent grid charging. Most homeowners in PG&E territory choose “solar-only charging” to comply with NEM requirements and maximize savings.

7. What happens if I use more electricity than my solar produces?

You’ll still receive energy from PG&E, and you’ll be billed at normal rates for that extra usage. Your solar + battery system helps reduce this by covering as much of your home’s load as possible.

How to Download Your PG&E Green Button Electricity Usage Data (For Solar & Battery Analysis)

When you have solar, understanding your true energy usage—especially seasonal changes and evening demand—is important for evaluating battery storage, expanding your solar system, or applying for programs like SGIP. One of the most helpful tools is your PG&E Green Button electricity usage download.

This quick guide will show you exactly how to download your energy usage data from PG&E in just a few minutes.

Step-by-Step Instructions

1. Log in to your PG&E Account

Visit: https://www.pge.com/

Sign in using your username and password.

If you have multiple service accounts, make sure the correct home or property is selected.

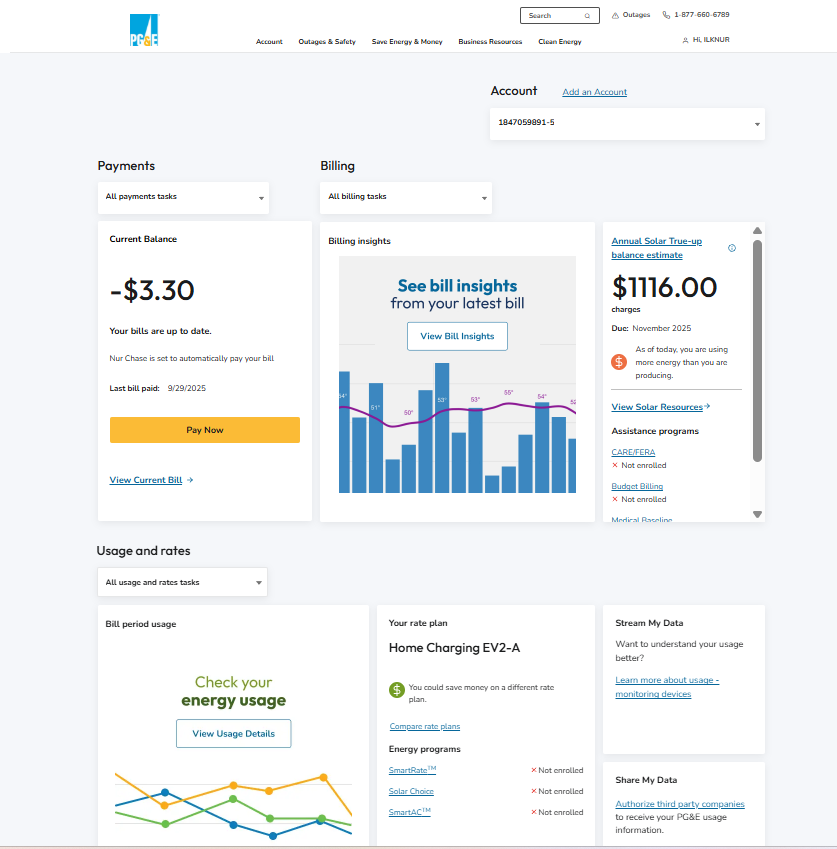

PG&E Customer Dashboard Home Screen

2. Go to “Energy Usage”

After logging in, look for the Usage and Rates section on your dashboard.

Click Energy Usage Details or simply Energy Usage.

This will take you to your Energy Usage Summary page, where you can see month-to-month electricity usage graphs.

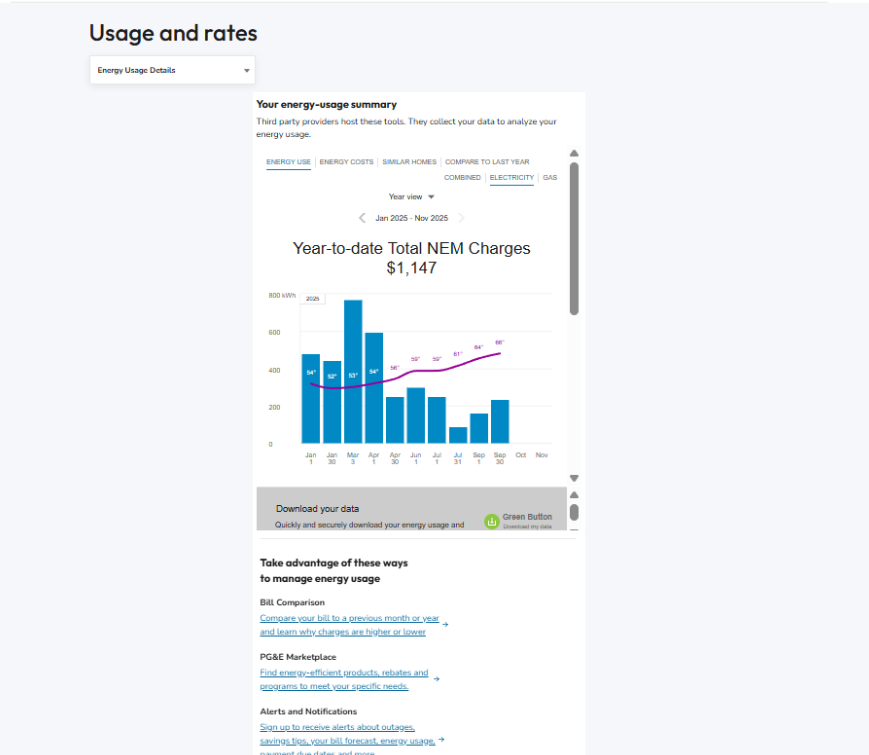

PG&E Energy Usage Summary showing year-to-date NEM charges and monthly electricity usage graph for a solar customer.

3. Look for the Green Button

In the middle of the page, you’ll see a button labeled:

Green Button – Download My Data

This is the official PG&E data export tool.

Click Green Button.

4. Choose Your Download Format

A pop-up will appear with several download options.

Select the last option (usually called *“Download My Data (CSV)” or “Custom Date Range (CSV)”).

5. Select Your Date Range

For most solar or battery assessments, we need 12 full months of usage history.

Set the Start Date to one year ago from today

Set the End Date to today

Example:

If today is March 1, 2026 → choose March 1, 2025 to March 1, 2026.

6. Download Your File

Click Download and save the .csv file to your computer.

This file contains hourly or daily usage data that allows us to evaluate:

How much power you use during peak (4–9 PM)

How your solar production offsets your consumption

Whether a battery or additional solar is beneficial

Eligibility and sizing for SGIP rebates

Why This Data Matters

Having accurate usage data helps us:

✅ Size your solar + battery systems correctly

✅ Calculate your projected savings

✅ Determine SGIP rebate eligibility

✅ Analyze electric vehicle or heat pump load impacts

✅ Understand your true NEM charges and true-up trends

Need Help? We’re Here.

If you’d like, you can email us the .csv file, and our design team will run a full usage + savings analysis.

Email: info@AllyElectricAndSolar.com

Phone: 510.559.7700

Website: www.AllyElectricAndSolar.com

Ally Electric & Solar Inc.

“Ô, Sunlight! The most precious gold to be found on Earth.” — Roman Payne

CSLB License #806465 | 855 Marina Bay Pkwy Ste. 280, Richmond, CA 94804

Do I Need to Upgrade My Electrical Panel for Solar, Batteries, or an EV Charger?

If you’re a Bay Area homeowner thinking about adding solar panels, a Tesla Powerwall or Enphase battery, or an EV charger, you’ve probably run into this question:

👉 “Do I need to upgrade my electrical panel first?”

As an electrician who’s worked in hundreds of homes across Berkeley, Oakland, Richmond, and Walnut Creek, here’s my straightforward answer:

⚡ Why Your Panel Matters

Your breaker panel is the heart of your home’s electrical system. Every outlet, appliance, and new solar or EV connection runs through it. If your panel is old, undersized, or outdated, it can become overloaded and unsafe.

Signs you may need an upgrade:

Frequent breaker trips

Panel feels warm to the touch

Flickering lights when multiple appliances run

Brands like Federal Pacific or Zinsco (these are known safety hazards)

You have a 100-amp panel but want to add solar, a battery, or an EV charger

☀️ Solar + Battery = Extra Load

When you add solar panels or a backup battery system (like Tesla Powerwall or Enphase 10C), your panel has to handle more equipment. Even if your solar “produces” power, the panel still has to route and manage that energy. Many Bay Area homes built before the 2000s simply weren’t designed for this.

🚗 EV Chargers Draw Heavy Power

A standard EV charger can draw as much power as your oven or HVAC system. Add that on top of existing loads — plus solar or a battery — and your old panel may not keep up.

✅ The Bottom Line

Not every homeowner needs a panel upgrade, but many do once they add solar, a battery, or an EV charger. The only way to know for sure is to have a licensed electrician check your setup.

👷 What We Recommend

At Ally Electric & Solar, we’ve been upgrading electrical panels and installing solar + battery systems in the Bay Area for over 24 years. We’ll:

Inspect your existing panel

Calculate your home’s load needs

Tell you if an upgrade is required (and why)

Handle both the upgrade and the solar/battery installation so everything works safely and smoothly

📞 Call us today to schedule a free safety check or visit www.allyelectricandsolar.com.

👉 Short answer: Yes, you might need an electrical panel upgrade for solar, batteries, or an EV charger. But the best answer comes from a trusted electrician who knows your home.

At Ally Electric & Solar, we’ve been helping Bay Area homeowners for 24+ years with electrical upgrades, solar, batteries, and EV charger installations. If you’ve got questions, we’ve got answers — and real solutions that work for your home.

📞510-559-7700 Call today for a free safety check, or visit us at www.allyelectricandsolar.com.

Can I Add a Battery to My NEM 2.0 Solar System Without Losing My Status?

If you installed solar before April 2023, you probably have NEM 2.0 — one of California’s most favorable net metering programs. Understandably, homeowners often worry that adding a battery today might force them into NEM 3.0, which offers much lower export credit rates.

The good news? You can add a battery to your existing NEM 2.0 solar system and keep your NEM 2.0 status — if you do it correctly.

NEM 2.0 + Battery: What the CPUC Says

The California Public Utilities Commission (CPUC) explicitly allows homeowners to add paired energy storage to an existing solar system without triggering a tariff change.

Paired Storage means your battery charges only from your solar system, not from the grid.

As long as no new solar generation is added (or it’s under 10% of your original system size / 1 kW, whichever is greater), your NEM 2.0 agreement stays intact.

What About Exporting Battery Energy?

Many homeowners ask:

“If my solar panels and my battery export power to the grid at the same time, am I exceeding my original system size?”

Here’s the key distinction:

System size is defined by your solar inverter’s AC rating, not your momentary export.

A battery isn’t considered new generation — it’s just time-shifting solar energy.

You can export solar-charged battery energy back to the grid and still get full NEM 2.0 credit.

This means that even if your solar system is exporting 6 kW while your battery discharges 5 kW at the same time (total 11 kW), you are still within your NEM 2.0 rights.

How PG&E’s Portal Handles It

When you submit your interconnection application to PG&E, you’ll see a question:

“Do you plan to limit export?”

In most cases, the answer is No for a NEM 2.0 paired-storage retrofit.

No = Open Export: Your battery and solar can export their full output when available, earning you credits.

Yes = Export Cap: This is used only if PG&E or your AHJ imposes a service size or Rule 21 export limit that you must enforce.

Our Process at Ally Electric & Solar

When we retrofit batteries like the Enphase IQ 10C onto existing NEM 2.0 systems, we:

Configure the battery to charge only from solar (paired storage compliance).

Confirm that the interconnection is filed as a “Standard NEM Paired Storage” project, not as a new solar system.

Leave export open unless your utility specifically requires a limit.

Provide documentation citing CPUC Decision D.16-01-044 to ensure PG&E keeps you on NEM 2.0.

💡 Why Add a Battery Now?

With time-of-use rates and evening peak prices climbing, batteries let you:

Store your own solar power for nighttime use.

Ride through power outages with backup capability.

Maximize your NEM 2.0 benefits before the 20-year term expires.

Bottom Line

Adding a battery to your NEM 2.0 system is one of the best investments you can make right now — and it won’t bump you into NEM 3.0 if it’s done properly.

Want to explore whether a battery is right for your home? Contact Ally Electric & Solar today at 510-559-7700 — we’ll check your existing system, design a solution with the right size battery, and handle the entire PG&E interconnection process for you.